In today’s interconnected world, businesses are no longer judged solely on financial performance. Investors, regulators, employees, and communities increasingly look at how a company operates beyond profit margins. They want to know how it treats the environment, how it engages with society, and how it governs itself. This is where the concept of ESG, Environmental, Social, and Governance becomes central.

Table of Contents

ToggleWhat is an ESG Framework?

An ESG framework is a structured system that helps organizations evaluate, report, and communicate their performance in these three dimensions. It is not just about compliance or public relations; rather, it provides a transparent lens into how a company manages risks, seizes opportunities, and contributes to sustainable development.

Think of an ESG framework as a blueprint. It outlines the metrics, disclosures, and qualitative information that organizations should report to stakeholders. For example, under the environmental pillar, it might include greenhouse gas emissions, energy use, water consumption, and waste management practices. Under the social pillar, it could cover workplace diversity, human rights, employee well-being, and community engagement. The governance pillar usually addresses board composition, executive compensation, anti-corruption measures, and transparency in decision-making.

The value of ESG frameworks lies in creating comparability and accountability. Without them, sustainability disclosures would be inconsistent, incomplete, or unreliable. With them, stakeholders can assess performance using common benchmarks. For businesses, adopting an ESG framework helps integrate sustainability into strategy, manage reputational risk, and attract socially conscious investors.

At its core, an ESG framework bridges the gap between corporate responsibility and measurable impact. It enables organizations to demonstrate not only what they do, but also how their actions create value for shareholders and society alike.

ESG Frameworks vs ESG Standards: What’s the Difference?

In the world of sustainability reporting, the terms framework and standard are often used interchangeably, but they are not the same. Understanding the difference is essential for any organization aiming to report responsibly and build credibility with stakeholders.

An ESG framework provides broad principles and guidelines. It tells companies what areas of disclosure they should focus on but leaves flexibility in how the information is presented. Frameworks are like roadmaps that guide organizations to think about their impact, risks, and opportunities. They offer structure without prescribing exact metrics. For example, the Task Force on Climate-related Financial Disclosures (TCFD) is a framework. It encourages companies to disclose climate risks and strategies but does not dictate a fixed set of numerical indicators.

On the other hand, ESG standards are much more prescriptive. They define how data should be measured, what metrics should be used, and in some cases even the exact terminology to apply. Standards make disclosures comparable across companies and industries because everyone is using the same measurement rules. For instance, the Global Reporting Initiative (GRI) standards tell companies exactly which indicators to report on, such as the percentage of renewable energy in total energy consumption or the gender composition of the workforce.

To simplify:

Frameworks = Principles and guidelines (the “what” to report).

Standards = Specific rules and metrics (the “how” to report).

Organizations often use a combination of both. A company might follow a framework like TCFD to decide which topics are most material to disclose, while relying on standards like GRI or SASB (Sustainability Accounting Standards Board) to ensure that disclosures are consistent and comparable.

For businesses, distinguishing between the two helps avoid confusion and strengthens credibility. Investors and regulators increasingly expect companies not only to describe their strategies and commitments but also to back them up with hard data. Using frameworks without standards can result in vague, qualitative reports. Using standards without frameworks may produce detailed numbers but lack the context of why those numbers matter. Together, they form the backbone of meaningful ESG reporting.

The Leading ESG Frameworks and Standards in 2025

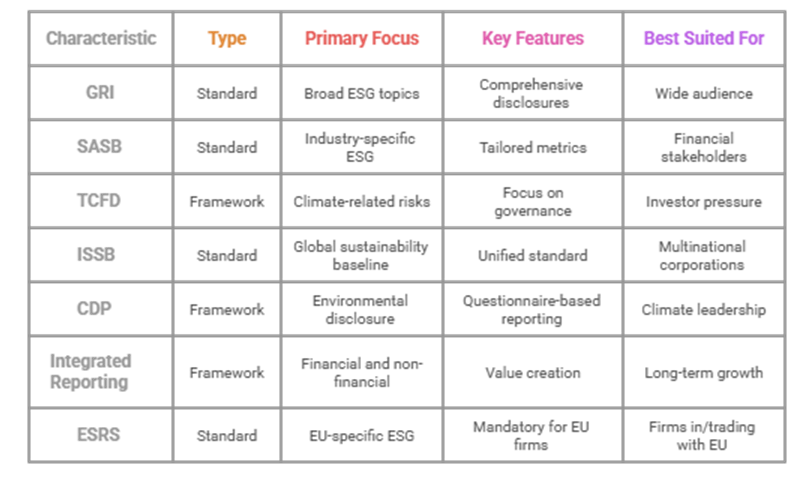

The ESG reporting landscape has expanded rapidly, with several globally recognized frameworks and standards emerging as leaders. While each has its own focus, together they form the backbone of sustainability reporting. Understanding their scope helps organizations choose the right fit based on industry needs, stakeholder expectations, and regulatory pressures.

Here is an overview of the most prominent ESG frameworks and standards in 2025:

Key Insights:

- GRI remains the most widely used standard, especially for organizations wanting to address a broad set of stakeholders, from NGOs to customers.

- SASB and ISSB appeal strongly to investors by focusing on financial materiality and industry-specific ESG factors.

- TCFD is critical for climate-related disclosures, and it has now been largely incorporated into ISSB standards, but many organizations still refer to TCFD guidance directly.

- CDP is influential in climate disclosure, particularly for companies seeking to demonstrate accountability on carbon and water.

- Regional standards like ESRS are gaining prominence, driven by mandatory regulations in Europe, which are shaping reporting expectations globally.

For companies, the challenge in 2025 is not the lack of options but navigating which framework or standard fits best with their purpose, audience, and regulatory obligations. Most organizations end up using a combination, for example, GRI for broad sustainability reporting, SASB for investor-focused data, and TCFD/ISSB for climate risk disclosure.

A Global Standard in ESG Reporting

For more than a decade, one of the biggest challenges in ESG reporting has been the fragmentation of frameworks and standards. Companies often struggled with overlapping requirements, unclear guidance, and stakeholder demands for multiple types of disclosures. Investors frequently complained that ESG data was inconsistent, making it difficult to compare performance across industries and geographies.

In recent years, momentum has grown toward creating a global baseline for sustainability reporting. This effort has been driven largely by the establishment of the International Sustainability Standards Board (ISSB), under the umbrella of the IFRS Foundation. The ISSB was formed in 2021 to consolidate existing approaches and provide a unified global standard that could be used across markets. By 2025, ISSB standards are increasingly seen as the cornerstone of ESG reporting worldwide.

The ISSB builds on the work of the SASB Standards and the Task Force on Climate-related Financial Disclosures (TCFD). By integrating these approaches, the ISSB offers companies a more streamlined way to report on sustainability and climate risks. Its goal is to deliver decision-useful information for investors, ensuring that ESG data is not just descriptive but financially material.

At the same time, regional initiatives like the European Sustainability Reporting Standards (ESRS) and country-level regulations are aligning with ISSB principles. While ESRS retains its own requirements to reflect EU policy priorities, there is increasing interoperability between global and regional standards. This is a critical step forward: companies operating in multiple jurisdictions can now align disclosures rather than prepare completely separate reports.

The vision of a global standard is not only about harmonization but also about credibility and accountability. A unified baseline improves investor confidence, reduces reporting fatigue for companies, and provides stakeholders with clearer insights into organizational performance. It also ensures that ESG disclosures are no longer just voluntary narratives but part of mainstream financial reporting, carrying the same weight as balance sheets or income statements.

However, while progress has been substantial, challenges remain. Different stakeholders still have varying priorities: civil society often demands broad impact reporting on social and environmental issues, while investors prioritize financially material disclosures. Balancing these needs is ongoing work. Yet, the trajectory is clear, ESG reporting is becoming more standardized, reliable, and globally recognized.

By 2025, the ISSB’s role in establishing a global baseline means that companies can no longer treat ESG as an optional add-on. It is becoming a central component of business reporting, a shift that reflects the growing recognition that financial performance and sustainability performance are inseparable.

So, How Do You Choose the Right Framework(s)?

With so many ESG frameworks and standards available, it can feel overwhelming for companies to decide which one is the best fit. There is no single answer because each business operates in a different context. The right choice depends on who your stakeholders are, where you operate, and what your long-term goals look like.

The first step is to understand that you do not need to adopt every framework at once. Many successful organizations begin with one or two that align closely with their business priorities and then expand over time. For example, a company that wants to show its environmental impact to a wide audience might start with the Global Reporting Initiative. A business that is heavily investor focused might lean toward the Sustainability Accounting Standards Board or the ISSB. Firms that operate in Europe will need to pay close attention to the European Sustainability Reporting Standards, as these are becoming mandatory.

Another important step is to talk to your stakeholders. Ask investors, employees, and even customers what kind of information they expect. Some may want detailed climate disclosures, while others may care more about diversity, governance, or supply chain impacts. Matching reporting to these expectations helps build trust and ensures that the data you publish will be meaningful.

It is also wise to think about the future. Regulations around ESG reporting are increasing every year. By choosing frameworks that are already well aligned with global standards, you prepare your business for compliance before it becomes a legal requirement. In other words, choosing wisely today reduces risks tomorrow.

Finally, keep in mind that reporting is not just about filling out a checklist. The purpose of ESG frameworks is to help companies think more deeply about their role in society and the environment. They are tools to guide better decision-making, not just documents to be shared with regulators or investors. When used in this way, they become a driver of long-term value and resilience.

Choosing the right ESG framework is therefore a matter of balance. It means aligning your reporting with your industry, your stakeholders, and your future ambitions. It is about finding the structure that not only meets compliance but also strengthens your story as a responsible and forward-looking organization.

Factors to Consider When Selecting an ESG Framework

Choosing an ESG framework is not a one-size-fits-all decision. The right fit depends on the specific realities of your business. Below are four key factors that should guide the process.

i. Industry Requirements

Every industry has its own unique impacts on the environment and society. A mining company, for example, faces very different risks and responsibilities compared to a technology firm. This is why some standards, such as SASB and ISSB, are designed with industry-specific metrics. They help businesses focus on the issues that matter most to their sector. When selecting a framework, companies should carefully review which indicators are most relevant to their industry. This not only makes the reporting more meaningful but also ensures that resources are not wasted on irrelevant data.

ii. Stakeholder Expectations

Stakeholders are at the heart of ESG reporting. Investors, regulators, employees, customers, and communities all have different interests in how a business operates. Some may focus on climate risks, while others may care deeply about labor practices or diversity. Engaging stakeholders through surveys, dialogues, or materiality assessments helps companies understand which issues should be prioritized. Selecting a framework that reflects these expectations creates stronger trust and credibility. When stakeholders feel heard, they are more likely to support and invest in the company’s long-term strategy.

iii. Regulatory Compliance

The regulatory landscape for ESG reporting is tightening around the world. The European Union’s CSRD requires companies to adopt ESRS, while many countries are aligning with ISSB standards. Ignoring these requirements can lead to legal risks, reputational damage, and financial penalties. Organizations need to evaluate where they operate and which regulations apply to them. Selecting frameworks that meet or anticipate regulatory expectations ensures that reporting is not only useful but also compliant. It also demonstrates that the company is proactive rather than reactive in addressing global sustainability rules.

iv. Reporting Costs and Resources

ESG reporting can be resource intensive. Collecting accurate data, ensuring its quality, and preparing reports require staff time, technical expertise, and sometimes new digital tools. Smaller businesses in particular may find this challenging. When choosing a framework, companies need to consider whether they have the resources to meet its requirements. A highly detailed standard may be valuable, but if it overwhelms the organization’s capacity, it could lead to incomplete or unreliable reporting. The most effective approach is to balance ambition with practicality — start with what is manageable, and then scale up as capacity grows.

Together, these factors provide a roadmap for businesses to choose the ESG framework that fits their goals, obligations, and capabilities. When companies take the time to align frameworks with their industry, stakeholder needs, regulations, and available resources, ESG reporting becomes not just a compliance exercise but a meaningful driver of resilience and reputation.

Common Mistakes Companies Make in ESG Framework Selection

While more companies are embracing ESG reporting, many still struggle with choosing the right framework. In the rush to demonstrate responsibility, organizations often fall into avoidable mistakes that weaken the quality and credibility of their reports. Understanding these pitfalls can help businesses make smarter decisions.

Focusing only on popularity

One common mistake is selecting a framework simply because it is widely used or trending. While global recognition is important, not every framework is the right fit for every business. A company should choose a framework that reflects its sector, its risks, and its audience, rather than following the crowd.

Overloading on multiple frameworks

Some organizations attempt to adopt too many frameworks at once. This often creates confusion, duplication, and unnecessary costs. While combining certain frameworks and standards can be valuable, trying to cover them all can overwhelm internal teams and reduce the quality of reporting. A focused approach is usually more effective than spreading resources too thin.

Ignoring stakeholder input

Another mistake is overlooking the voices of stakeholders. Companies sometimes choose frameworks without asking investors, regulators, employees, or communities what information matters most to them. This leads to reports that look polished but fail to answer the questions stakeholders are actually asking.

Treating ESG as a compliance exercise

Too often, businesses see ESG reporting only as a box to tick for regulators or investors. This mindset reduces the value of the framework and misses the opportunity to integrate ESG into strategy and decision-making. A framework should not be seen as a burden but as a tool to strengthen resilience and long-term value creation.

Failing to build internal capacity

ESG reporting requires accurate data, technical knowledge, and cross-departmental coordination. Some companies adopt frameworks without first ensuring that their teams have the training and resources needed to manage the process. This can result in incomplete or inconsistent reports. Building capacity before or alongside adoption is critical.

Neglecting future regulations

Finally, many companies choose frameworks that meet current needs but fail to anticipate upcoming regulatory requirements. With governments and financial institutions tightening rules around sustainability disclosures, this short-sightedness can force businesses to redo reporting processes at higher costs in the future.

Avoiding these mistakes requires planning, consultation, and a long-term vision. When businesses approach ESG frameworks thoughtfully, they not only produce stronger reports but also build a culture of accountability and transparency that benefits both the company and its stakeholders.

Aligning ESG Reporting with UN SDGs and Global Sustainability Goals

ESG reporting does not exist in isolation. It is part of a wider global effort to build a sustainable future, and one of the most important anchors for this effort is the United Nations Sustainable Development Goals (SDGs). Adopted in 2015, the 17 SDGs provide a roadmap for tackling the world’s most pressing challenges, from ending poverty and hunger to ensuring clean energy, climate action, and gender equality.

For businesses, aligning ESG reporting with the SDGs adds depth and credibility. It shows that an organization’s sustainability work is not just about meeting investor expectations but also about contributing to global priorities. When a company reports on issues like carbon emissions, workplace diversity, or responsible supply chains, these disclosures can be directly linked to specific SDGs such as Climate Action, Gender Equality, or Responsible Consumption and Production. This makes reporting more meaningful and relevant, not only for shareholders but also for society at large.

Global frameworks are also moving toward greater alignment with the SDGs. For example, the Global Reporting Initiative (GRI) has mapped many of its indicators to the SDGs, helping companies demonstrate how their disclosures connect to global targets. Similarly, investors are increasingly asking for evidence of how corporate sustainability strategies contribute to the 2030 Agenda for Sustainable Development.

The benefits of this alignment are significant. It enhances transparency by connecting company-level actions to global outcomes. It improves comparability by showing how businesses across sectors are contributing to shared goals. And it strengthens stakeholder trust by demonstrating that companies see themselves as active participants in addressing worldwide challenges rather than simply focusing on internal compliance.

Aligning with global goals also creates opportunities for innovation and partnerships. Companies that link their ESG strategies with the SDGs often discover new markets, attract socially responsible investors, and form collaborations with governments and NGOs. This not only drives business value but also accelerates progress toward solving collective problems.

In short, aligning ESG reporting with the SDGs and global sustainability goals transforms reporting from a narrow exercise into a broader statement of purpose. It shows that business success and sustainable development go hand in hand, and that companies can be both profitable and purposeful in shaping a better world.

Not Sure Where to Start? Let AI Geo Navigators Guide You to the Right ESG Framework

For many organizations, the idea of selecting an ESG framework can feel overwhelming. With multiple options available and increasing regulatory pressure, it is easy to get lost in the details or delay important decisions. The truth is that starting the ESG journey does not have to be complicated. What is needed is the right guidance, expertise, and a structured approach.

This is where AI Geo Navigators can support your organization. Our team brings together expertise in sustainability, governance, data management, and reporting to help companies choose the ESG framework that best matches their industry, stakeholder needs, and long-term vision. We understand that every organization is different. A manufacturing firm may face complex environmental disclosures, while a financial institution may need stronger governance reporting. Our role is to simplify these complexities and design a path that is practical, compliant, and future-ready.

We go beyond helping companies pick a framework. We work closely with organizations to integrate ESG practices into business strategy, train teams on reporting processes, and build systems that make disclosures accurate and reliable. Whether it is aligning with GRI for broad sustainability impact, ISSB for investor-focused reporting, or ESRS for compliance in Europe, we ensure that companies adopt the right structure without wasting resources.

Most importantly, our guidance is grounded in purpose. ESG is not just about filling out reports; it is about creating value for both business and society. At AI Geo Navigators, we see ESG frameworks as tools for transformation that help organizations strengthen resilience, reduce risks, attract investment, and build trust. If you are unsure where to begin, we can help you take the first step with confidence. Together, we can turn ESG reporting from a challenge into an opportunity for growth, innovation, and impact.