We are living through the end of one era. Not the end of democracy. Not the end of capitalism. And certainly not the end of human progress.

What’s ending is quieter slower, but unstoppable. It’s the end of the carbon molecule as our measure of success. For over two centuries, it defined growth, power and comfort. But the world is changing. The molecule’s reign is fading.

A new state is emerging one powered by electrons, not combustion. By storage, not extraction. By imagination, not depletion.

You can already feel it. It’s in our markets, our cities, our homes in the way we make, move, and consume. Yet, many still hold on to the familiar; to the myth that what once worked will always work.

But change doesn’t announce itself with a crash. It arrives as convergence and it’s already here.

Table of Contents

ToggleSignal One: The Power-Mix Tipping Point

The first sign came quietly, almost unnoticed in our power mix.

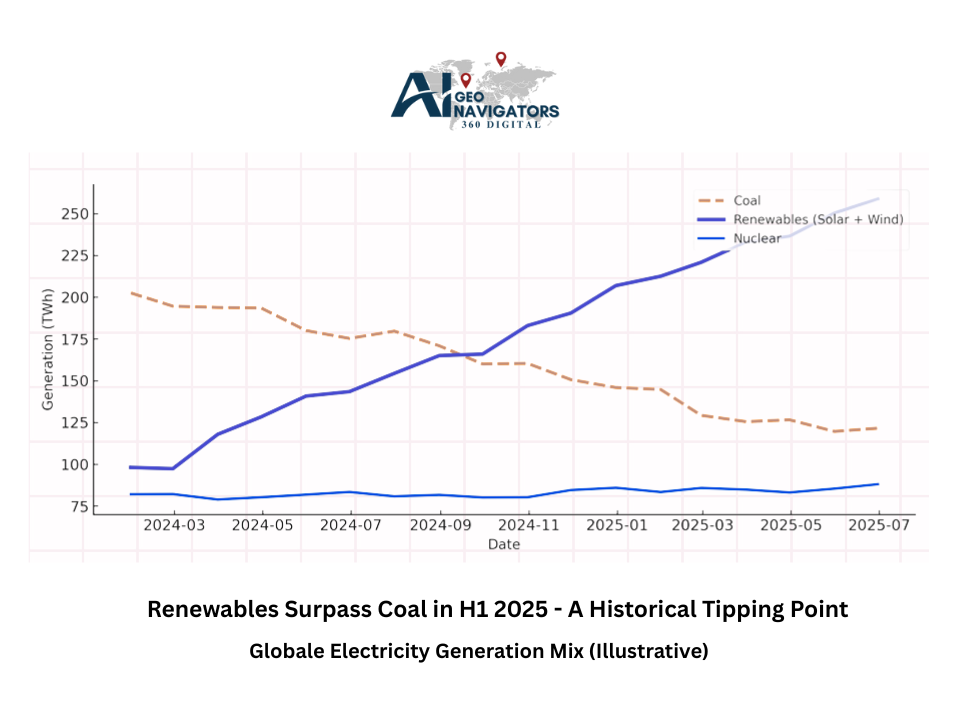

In the first half of 2025, global solar and wind generation surpassed coal for the first time in history. Not forecasts …real data.

The International Energy Agency (IEA) now confirms renewables will outproduce coal for the entire year. And by 2027, clean and low-emission sources renewables and nuclear combined…. will meet all net electricity demand growth.

That’s more than a milestone. It’s a moment of truth. The molecule’s monopoly is over. We didn’t run out of coal …we just found better economics.

Figure 1: Global Electricity Generation Mix (Illustrative) — Renewables surpass coal in H1 2025.

Signal Two: Economics Unbound

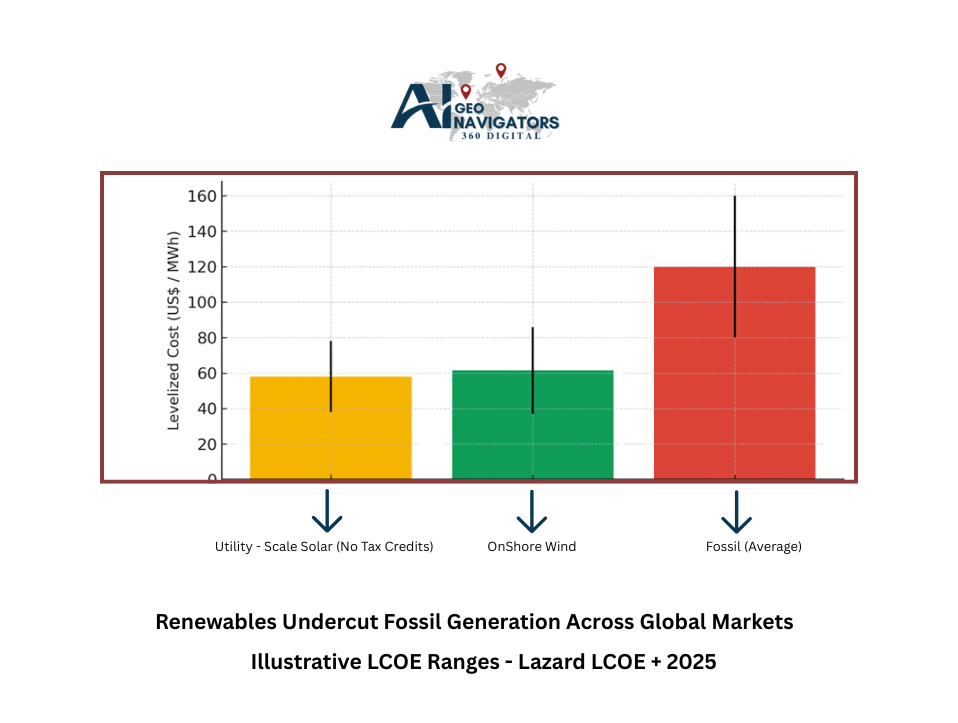

The second sign came from the numbers. They don’t lie and they don’t argue.

The Lazard LCOE+ 2025 Report puts utility-scale solar (without tax credits) between US$38 and $78 per MWh, and onshore wind between $37 and $86. Fossil fuels? Far higher.

IRENA reported last year that the global average cost of solar PV was 56% lower than fossil-based generation. Onshore wind was 67% lower.

Fuel that costs nothing wins every single time.

And the pattern is spreading. We’re seeing it in transport, where EVs now cost less to own and operate. In buildings, where heat pumps outperform gas systems several times over. In industry, where electrified heat is finally competitive. Even in agriculture, where smarter farming is using less energy and fewer inputs.

Figure 2: Illustrative LCOE Ranges — Lazard LCOE+ 2025.

Signal Three: Capital Great Reallocation

If there’s one thing we know …. money moves faster than molecules.

According to the IEA’s 2025 Global Energy Investment Report, total energy investment is expected to hit $3.3 trillion, with electricity generation, grids, and storage spending now 50% higher than fossil fuel supply.

This isn’t philanthropy. It’s math. Investors are moving where the returns are real and the risks are shrinking.

They’re not waiting for regulation or politics. They’re following logic — investing in what endures.

We have to build reliability that acknowledges decline, not pretend the old curve still climbs upward.

Signal Four: Electrification Across Six Sectors

Electrification is everywhere.

Energy: Renewables now outpace coal, while battery storage costs keep falling — down roughly 20% year-on-year (Bloomberg NEF).

Transport: The IEA’s EV Outlook 2025 projects 20 million EVs sold this year, nearly a quarter of all new cars. In China, it’s more than half.

Buildings: Heat pumps are scaling fast. In Europe, they already cost less than gas systems over their lifetime.

Food & Agriculture: Electric tractors, precision irrigation, and methane capture are rewriting efficiency norms.

Industry: Steel and cement are turning a corner with recycled inputs and electrified furnaces.

Waste: Circular systems and methane recovery are transforming what was once pollution into profit.

We can’t just switch oil off overnight …. we’d freeze, stall, and strain the world. But investing in it as if nothing’s changed? That’s denial, not strategy.

Signal Five: The Gravity of Subsidies

The IMF estimated fossil-fuel subsidies at $7 trillion in 2022 …. about 7% of global GDP. Imagine if even half that fueled clean systems.

But the tide’s turning. Carbon pricing, investor pressure, and plain economics are exposing the real costs of pollution. Renewables reduce volatility, cut imports, and free economies.

It’s simple: carbon is losing its return profile. The market knows it.

The Antithesis: A Migration, Not an Abandonment

This transition isn’t about abandoning oil tomorrow. It’s a migration ….. one that’s already well underway.

Hydrocarbons still matter, just like horses did when cars first appeared. But pouring more money into extraction when substitution is accelerating? That’s like buying taxis the year Uber launched.

Every investor, policymaker, and company now stands somewhere between two realities …. decline and creation. The choice is clear: be part of the next chapter or get stuck writing footnotes to the last one.

The Rewards of Seeing Early

For those reading these signals clearly, the rewards are already showing:

Economic: Lower operating costs, fewer stranded assets, and access to new markets.

Political: Greater energy independence and fewer shocks.

Environmental: Huge cuts in CO₂ and methane. Cleaner air, healthier cities.

Social: Purpose, innovation, and jobs built on sustainability — not sacrifice.

This isn’t ideology anymore. It’s economics. The math of transition now beats the myth of permanence.

The Call to Action

To investors — price the endgame honestly. Stop treating carbon as infinite.

To policymakers — build grids faster. Simplify incentives. Retire what’s obsolete.

To business leaders — electrify what you can, mitigate what you can’t, and step away from what no longer creates value.

We are entering the electro-state, a world powered by intelligence, electrons, and intent. The question isn’t whether we’ll adapt. It’s whether we’ll lead.

For two centuries, carbon was king. It built our cities, fueled our rise, and defined modern life.

But no reign lasts forever. The next one won’t end in depletion — it’ll end in replacement.

We’re not running out of fuel. We’re running out of excuses.

This isn’t the end of progress. It’s the beginning of something cleaner, smarter, and far more human — the climate economy.

AI Geo Navigators: Moving from Carbon to Clean Energy

At AI Geo Navigators, we believe the future will be defined not by what we extract, but by what we create, not by the power of carbon, but by the precision of electrons and intelligence.

World is steadily shifting toward cleaner, smarter and more resilient systems, and our mission is to help accelerate that transformation.

Our work focuses on integrating renewable energy intelligence, AI-driven spatial modeling, and sustainability insights to guide smarter decision-making.

From mapping potential solar and wind corridors to assessing climate risks and optimizing resource efficiency, we help stakeholders visualize what a clean energy future truly looks like, one grounded in data, not dependence.