As climate change continues to pose one of the greatest challenges to our planet, the urgency for effective climate solutions is greater than ever. One of the growing methods to help combat this crisis is carbon credits. They have gained global attention as a tool to help businesses, organizations, and governments manage their greenhouse gas (GHG) emissions. But how do carbon credits work, who uses them, and why are they crucial in our efforts to reduce global emissions? This guide will cover the essential aspects of carbon credits, including how they function, who sells them, the benefits of carbon projects, and why companies buy them.

Table of Contents

ToggleWhat Are Carbon Credits?

A carbon credit is a tradable certificate or permit that represents the right to emit one metric ton of carbon dioxide (CO2) or its equivalent in other greenhouse gases (GHGs). Essentially, it is a financial instrument that allows businesses, governments, and individuals to offset their carbon emissions by investing in projects that either reduce or remove an equivalent amount of CO2 from the atmosphere. The concept of carbon credits is based on the principle of cap-and-trade systems. Under such a system, a limit or “cap” is set on the amount of greenhouse gases that can be emitted by certain entities. If an organization emits less than its allotted share, it can sell its excess credits to other companies that exceed their limits. This creates a financial incentive for businesses to reduce their emissions, as they can profit from the surplus credits they generate through emission reductions.

The Process of Carbon Credit Generation

Carbon credits are generated through carbon offset projects. These projects are designed to either reduce the amount of carbon being emitted into the atmosphere or capture and store it. Common examples of carbon offset projects include:

Reforestation and afforestation: Planting trees or restoring forests, which absorb CO2 as they grow.

Renewable energy projects: Solar, wind, and hydroelectric power projects that replace fossil-fuel-based energy sources.

Energy efficiency improvements: Upgrades to industrial processes, buildings, or transportation that reduce the amount of energy used and consequently decrease emissions.

Methane capture: Projects that capture methane emissions from landfills, agriculture, or other sources, preventing this potent greenhouse gas from entering the atmosphere.

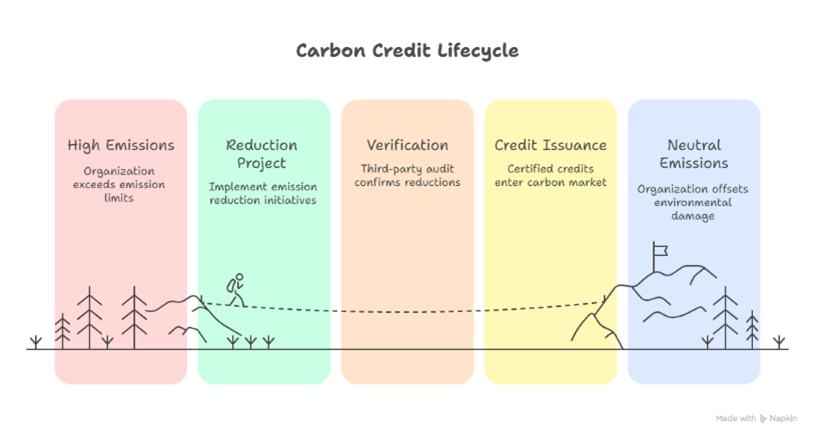

Once a carbon offset project is implemented, it is verified by third-party organizations to ensure that the emissions reductions are real, measurable, and additional to what would have occurred without the project. Following verification, carbon credits are issued and made available for sale on the market.

The Role of Carbon Credits in Climate Action

The primary goal of carbon credits is to encourage businesses and governments to reduce their greenhouse gas emissions and invest in environmentally beneficial projects. By purchasing carbon credits, organizations can neutralize their emissions by funding projects that offset the environmental damage they cause. In this way, carbon credits act as an essential tool in the global effort to combat climate change. They not only provide a financial incentive for emission reductions but also create a marketplace that connects emission-reducing projects with the companies and individuals who need to offset their emissions. Ultimately, carbon credits represent a practical and market-driven approach to addressing the complex and urgent problem of climate change.

How Do Carbon Credits Work?

The concept of carbon credits operates within a system designed to encourage the reduction of greenhouse gas emissions through offsetting and trade. Carbon credits are generated through projects that prevent or remove carbon emissions from the atmosphere, helping businesses, governments, and individuals meet their emission reduction targets. By purchasing carbon credits, organizations can neutralize their own emissions by funding projects that offset the environmental damage they cause.

The process begins with the establishment of emission reduction projects. These projects can range from large-scale initiatives such as reforestation, renewable energy, or energy efficiency upgrades. For example, a solar energy project generates carbon credits by replacing fossil-fuel-based power, which would otherwise emit CO2. Once the project is implemented, it must undergo a verification process to ensure that the emission reductions are real and measurable. Independent third-party auditors assess the project to ensure it meets international standards, such as the Verified Carbon Standard (VCS) or the Gold Standard. After successful verification, the emissions reductions are certified, and carbon credits are issued. Each credit represents one metric ton of CO2 or its equivalent in other greenhouse gases.

Once issued, these carbon credits can be bought and sold on carbon markets. In compliance markets, governments or international organizations regulate carbon credit trading, and companies that exceed their emissions limits are required to buy credits to meet regulatory requirements. In voluntary markets, companies and individuals can choose to purchase carbon credits as part of their corporate social responsibility efforts or sustainability strategies. This provides a flexible and market-driven solution for managing emissions and encouraging emission reductions.

When a company buys carbon credits, they are essentially paying for the emissions reductions that have been made elsewhere. These credits are then retired from the market to ensure they cannot be resold or double-counted. By participating in this system, organizations contribute to global climate goals, helping reduce the overall concentration of greenhouse gases in the atmosphere and mitigating the effects of climate change. Carbon credits provide a practical way for businesses to take responsibility for their environmental impact and invest in projects that support sustainable development and long-term climate solutions.

Who Sells Carbon Credits?

Carbon credits are sold by a range of entities that play crucial roles in creating, verifying, and trading carbon credits. The process begins with carbon offset project developers, who design and implement the projects that generate the credits. These developers are responsible for identifying emission reduction opportunities in sectors like forestry, renewable energy, waste management, and agriculture. They typically focus on activities such as planting trees, building renewable energy infrastructure, or capturing methane from landfills.

Once a project is established, its environmental impact is monitored, and emissions reductions are quantified, which results in the issuance of carbon credits. The next group of sellers in the market is carbon credit brokers. These intermediaries help link project developers with companies or individuals looking to buy credits. Carbon credit brokers facilitate transactions by offering advice on selecting the right projects and navigating the complex rules and standards that govern the carbon credit market. They can operate in both voluntary and compliance carbon markets, ensuring that buyers meet their sustainability goals while also aligning with regulatory requirements. Brokers act as key players in maintaining the liquidity of carbon credit markets, making it easier for businesses to purchase credits as needed.

Another important group involved in the sale of carbon credits are carbon registries. These organizations maintain digital records of carbon credits issued and traded. Registries are responsible for ensuring that credits are retired properly and cannot be reused or sold again once purchased. By tracking the creation and retirement of credits, they provide transparency to the market and help prevent fraud or double-counting. Some of the well-known registries include the American Carbon Registry, Gold Standard, and the Verified Carbon Standard (VCS).

In addition to these players, governments and regulatory bodies also sell carbon credits in compliance markets. For example, in systems like the European Union Emission Trading Scheme (EU ETS), governments allocate a certain number of carbon allowances to companies based on their emissions limits. Companies can trade these allowances in a regulated market, which creates a financial incentive for businesses to reduce their emissions. The role of governments in this market is to ensure that credits are issued, tracked, and retired according to national and international climate commitments. Ultimately, the selling of carbon credits involves a network of developers, brokers, registries, and governments that work together to create a system where businesses can offset their emissions and contribute to global climate solutions.

What Are the Benefits of Carbon Projects?

Carbon credit projects offer a wide array of environmental, economic, and social benefits that go beyond merely reducing greenhouse gas emissions. These projects play a crucial role in addressing climate change and supporting sustainable development across various regions.

Climate Change Mitigation

One of the primary benefits of carbon projects is their direct contribution to climate change mitigation. By supporting initiatives that reduce or remove CO2 from the atmosphere—such as reforestation, renewable energy, or methane capture projects—carbon credit programs help lower the overall concentration of greenhouse gases. This reduction is vital in slowing global warming and mitigating the effects of climate change, such as extreme weather events, rising sea levels, and the loss of biodiversity. These projects serve as essential tools in helping countries and companies meet their emissions reduction targets and contribute to global climate goals, including those set by the Paris Agreement.

- Economic Development

In addition to the environmental benefits, carbon projects often bring significant economic development to the regions where they are implemented. Renewable energy projects like solar farms or wind turbines reduce emissions while also creating jobs and stimulating local economies. These projects offer long-term employment opportunities in installation, maintenance, and operation, providing economic security to surrounding communities. Similarly, forest conservation and reforestation projects can generate income through activities such as sustainable timber harvesting, ecotourism, or carbon credit sales, which create financial opportunities for local residents. Moreover, carbon projects often lead to infrastructure development, such as the creation of roads, schools, and healthcare facilities, further improving the quality of life in the area

Improved Local Livelihoods

Many carbon offset projects are designed with a focus on sustainable development goals, benefiting local communities by providing access to clean energy, better agricultural practices, and employment opportunities. In rural areas, projects that introduce clean cookstoves or solar energy systems reduce dependence on harmful fossil fuels, leading to better health outcomes and a cleaner environment. These projects improve the standard of living by reducing air pollution and providing reliable energy sources for cooking, lighting, and heating. Furthermore, carbon credit projects often promote community empowerment by involving local people in decision-making processes and providing them with tools and knowledge to address climate change in their own regions.

Biodiversity Conservation

Carbon projects also contribute to the preservation of biodiversity. Many reforestation and afforestation projects not only sequester carbon but also help protect ecosystems and wildlife habitats. By preventing deforestation and promoting sustainable land use practices, these projects safeguard biodiversity, enhance ecosystem services, and restore degraded lands. Protecting forests and other natural ecosystems helps preserve water cycles, improves soil health, and prevents erosion—benefits that have far-reaching impacts for both the environment and local communities.

Corporate Social Responsibility

Finally, carbon credit projects can enhance corporate social responsibility for businesses. By investing in carbon reduction initiatives, companies can offset their own emissions, helping them meet sustainability goals and demonstrating their commitment to environmental stewardship. This can improve their public image, attract environmentally-conscious consumers, and strengthen their competitive position in the market. Companies that embrace these projects are seen as responsible corporate citizens, which can lead to long-term business success and profitability.

Requirements for Carbon Projects

Carbon credit projects must meet specific standards and requirements to ensure they deliver genuine and verifiable emissions reductions. These requirements are essential for maintaining the credibility and integrity of carbon markets, ensuring that the carbon credits issued are legitimate and contribute meaningfully to global climate goals.

Additionality

One of the first and most important requirements is additionality. This principle ensures that the emissions reductions achieved by the project would not have occurred without the funding provided by the sale of carbon credits. In other words, the project must produce carbon reductions that are extra—beyond what would have happened under normal circumstances. This is a critical element for ensuring that carbon credits represent real environmental value and are not merely the result of business-as-usual activities. Without additionality, carbon credits would fail to provide genuine mitigation of climate change, undermining the integrity of carbon markets.

Measurability

Another key requirement for carbon projects is measurability. The emissions reductions achieved by the project must be accurately measured and verified. To ensure this, projects need clear and transparent monitoring systems that can track the amount of carbon sequestered or avoided over time. The impact of the project on emissions must be quantifiable, and the methodology used for measuring these reductions must adhere to scientific principles and accepted standards. Verification is typically carried out by third-party auditors who assess whether the project has met its emissions reduction targets and followed the correct methodologies. This ensures transparency and accountability in the carbon credit market.

Permanence

Permanence is also a fundamental requirement for carbon projects. For example, projects that sequester carbon, such as reforestation or soil carbon sequestration, must ensure that the carbon remains stored for a long period. If the carbon stored by the project is released back into the atmosphere, for instance, through deforestation or fire, the emissions reduction becomes invalid. To mitigate this risk, carbon offset projects often incorporate measures to protect stored carbon for extended periods. This could involve insurance mechanisms or buffer funds that are set aside to account for any future loss of carbon storage, ensuring that the carbon reduction remains valid over the long term.

Leakage

The concept of leakage must also be considered when designing carbon projects. Leakage refers to the unintended increase in emissions in one area due to emissions reductions in another. For example, if a reforestation project reduces logging in one region but leads to increased logging in another area, the overall environmental benefit is diminished. To address this, projects must be carefully designed to minimize or avoid leakage. This can be achieved by ensuring that emissions reductions are not merely shifting the problem to another region or sector. Effective monitoring and management strategies can help prevent leakage and ensure the full environmental benefit of the project.

Sustainability Criteria

Finally, carbon projects must comply with sustainability criteria. These criteria ensure that the project does not negatively affect the environment, society, or local communities. The project should have positive environmental impacts, such as protecting biodiversity, improving soil and water quality, and enhancing ecosystem services. It should also provide social benefits, including the involvement of local communities, job creation, and improvements in livelihoods. Sustainable projects align with broader development goals and contribute to the long-term wellbeing of both the environment and local populations, ensuring that the carbon credit projects provide holistic benefits.

These requirements are essential for ensuring the credibility and integrity of carbon markets. By meeting these standards, carbon credit projects can deliver real, measurable, and lasting climate benefits that help drive global climate action.

Why Companies Buy Carbon Credits?

Companies buy carbon credits for a variety of reasons, primarily to manage their greenhouse gas emissions and meet sustainability goals. One of the main motivations is to offset emissions that cannot be directly reduced or eliminated by their operations. By purchasing carbon credits, businesses can contribute to global efforts in fighting climate change while taking responsibility for their environmental impact. This is particularly important for industries with high emissions, such as aviation, energy, and manufacturing, where completely eliminating emissions is often not feasible in the short term.

For many companies, purchasing carbon credits is a way to comply with regulatory requirements. Many countries have set binding targets for carbon reduction as part of international agreements such as the Paris Agreement. In regions with mandatory carbon pricing systems or cap-and-trade markets, companies are often legally required to buy carbon credits to meet their allotted emission limits. This ensures that the company remains compliant with national or international climate regulations and avoids penalties or fines for exceeding their emissions caps.

In addition to compliance, corporate social responsibility (CSR) is a significant reason companies choose to buy carbon credits. Businesses are increasingly expected to demonstrate their commitment to sustainability and environmental stewardship. By investing in carbon credit projects, companies can show stakeholders, including consumers, investors, and employees, that they are taking active steps to reduce their carbon footprint. This can enhance a company’s reputation, build trust with its customers, and attract investors who prioritize environmental sustainability. Companies that embrace CSR are seen as responsible and forward-thinking, which can result in increased brand loyalty and consumer demand.

For businesses aiming to achieve net-zero emissions or other ambitious climate goals, carbon credits play a critical role in balancing out emissions that are difficult to reduce through internal actions alone. Many companies, especially those in sectors like energy or logistics, recognize that it may take years or even decades to fully transition to low-carbon technologies. In the meantime, purchasing carbon credits allows them to neutralize their remaining emissions and meet net-zero or carbon-neutral targets. This is especially relevant as more companies set science-based targets aligned with global climate goals, and buying carbon credits is often a necessary step to reach those targets.

Additionally, buying carbon credits can help companies engage in sustainable development and support positive environmental and social outcomes. Many carbon credit projects are located in developing countries where they provide crucial benefits beyond just carbon sequestration. These projects can create jobs, improve local infrastructure, support biodiversity, and help vulnerable communities adapt to climate change. By purchasing carbon credits, companies contribute to these broader positive impacts, which aligns with their values and can lead to a more sustainable future for all.

In summary, companies buy carbon credits to meet regulatory requirements, offset emissions, fulfill corporate social responsibility, and contribute to a global climate solution. This helps them not only reduce their environmental impact but also build stronger relationships with customers, investors, and communities, all while supporting the broader effort to mitigate climate change.

Can You Make Money from Carbon Credits?

Yes, it is possible to make money from carbon credits, but like any financial asset, it requires understanding the market dynamics and participating strategically. Carbon credits are increasingly recognized as both a sustainable investment opportunity and a way to generate revenue for businesses involved in carbon offset projects. However, making money from carbon credits depends on several factors, including the type of carbon project, market conditions, and regulatory frameworks. One way to make money from carbon credits is by developing and selling credits from carbon offset projects.

Organizations that implement emission-reduction initiatives, such as reforestation, renewable energy, or methane capture, can generate carbon credits as a byproduct of their projects. Once these credits are verified by a third-party auditor, they can be sold on the carbon market. The price of the credits can vary depending on the project type, certification standard, and the demand for credits in the market. For example, reforestation projects tend to command higher prices due to the long-term carbon sequestration they provide, while renewable energy projects may have lower per-credit prices but larger-scale opportunities for credit generation.

Carbon credits can be traded on both voluntary and compliance markets, offering different avenues for generating revenue. In voluntary markets, companies and individuals buy credits to offset their emissions or demonstrate their commitment to sustainability. The price in this market is typically driven by demand from businesses wanting to enhance their corporate social responsibility (CSR) profile or meet net-zero targets. In compliance markets, carbon credits are bought and sold in regulated systems, such as the European Union Emission Trading Scheme (EU ETS).

Here, companies are required to meet emission reduction targets, and the demand for credits is driven by regulations that impose fines for exceeding emission limits. For investors, carbon credits represent an opportunity for speculative investment. Investors can buy carbon credits at lower prices when demand is low and sell them later when prices rise. The price of carbon credits is influenced by factors such as government policies, regulations, and climate targets. As governments set stricter emissions reduction goals and businesses face increasing pressure to offset their emissions, the demand for carbon credits may rise, leading to higher prices and potential profits for those who hold credits.

However, it is important to note that making money from carbon credits requires a careful understanding of the market. The carbon credit market can be volatile, influenced by factors like changes in regulation, global demand for credits, and the overall state of the economy. Additionally, supply chain risks and the integrity of carbon credit projects can affect their value. Therefore, businesses or individuals looking to profit from carbon credits should consider these risks and invest wisely, ensuring that they are supporting genuine, verified projects that provide long-term, sustainable value. In conclusion, while carbon credits offer an opportunity to make money through development, trading, and investment, success in this market requires a strategic approach, understanding market trends, and ensuring the integrity of the carbon offset projects involved.

Conclusion

Carbon credits are an essential tool in the global effort to combat climate change. By providing a market-driven approach to reducing emissions, carbon credits create a financial incentive for companies, governments, and individuals to invest in projects that lower carbon footprints and support sustainable development. These credits allow organizations to offset their emissions by supporting projects that reduce, remove, or avoid greenhouse gases, contributing to a cleaner and more sustainable future. The role of carbon credits extends beyond just mitigating climate change; they also offer significant economic, social, and environmental benefits. By supporting projects in vulnerable regions, carbon credits create jobs, improve livelihoods, and foster local development. At the same time, they contribute to the global transition towards renewable energy and sustainable land management practices.

While making money from carbon credits is certainly possible, it requires an understanding of the market and a commitment to supporting legitimate, verified projects. As demand for carbon credits grows, especially as companies aim for net-zero emissions, the carbon market will continue to play a pivotal role in addressing the challenges of climate change. By purchasing or investing in carbon credits, businesses and individuals can contribute to global climate action while also advancing their sustainability goals.